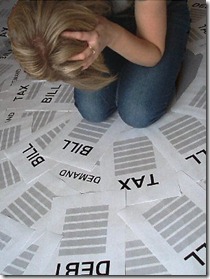

Debt. AKA- Spending tomorrow’s dollar today. It’s what has our country under it’s spell. It’s an enabler—enabling you to believe that you can have today what you want, because you’ll always have the job you have now—or will you?

And the funny thing is, now that the economy is doing poorly, the government is trying to stimulate you to go out and buy more things and get into further debt, rather than wanting you to reduce debt.

Fortunately, the American people are too smart for this, and many are taking this opportunity to settle their debt, and are going to great lengths to make it right through many different means of debt reduction—both doing it on their own, taking courses, or getting credit counselors.

How about you? Are you more aware of your debt now than you were before, and are you taking steps to make sure that you have an emergency fund just incase you need one?

We started our journey toward debt freedom close to three years ago now, and we’re not going back. From a house roof that we put on credit cards to pieces of two auto loans and a Christmas, we quickly learned that it’s much better for our sanity/peace and for our bottom line to not be in debt.

But that plan also meant that we had to have an emergency fund, because going into debt is the last thing you want to do in an emergency.

So get help, get out, and stay out. You don’t know what the future holds, and the borrower is truly slave to the lender.

The thing about fighting debt is that it’s really easy to be penny wise and pound foolish. It’s a cliche, but true. You save a little here, a little there, you cut back on things you don’t need and even some things you do need. And you feel good that you’re living right.

Then one fine day the market crashes, you’re in the middle of a recession and suddenly your investment portfolio tanks, and it’s all gone, and you’re left wondering if you should have just enjoyed your earnings, instead of sacrificing day after day and month after month, and then watching it all go up in smoke.

Well, on one hand it’s a moral question– is it better to spend my money or someone else’s? I mean, I can totally see what you’re saying: If I’m going to lose it all, and the government will be there for me, then why not spend as much as I can? But that’s what got us in this trouble in the first place– banks believing they were too big to fail.

So, there’s a moral underpinning to the decision to be debt free.

Well, on one hand it’s a moral question– is it better to spend my money or someone else’s? I mean, I can totally see what you’re saying: If I’m going to lose it all, and the government will be there for me, then why not spend as much as I can? But that’s what got us in this trouble in the first place– banks believing they were too big to fail.

So, there’s a moral underpinning to the decision to be debt free.

What galled me was when Geithner got up there and started talking about how the government needed to unfreeze credit so people could go out and get student loans (OK in my opinion), home loans (still OK in my opinion), auto loans (iffy; as low as prices are right now it should be easier to pay mostly cash), and more credit cards (WHAT?!?!?). THEN he goes on to say how the GOVERNMENT will be there with a stimulus package to help the people pay for what they just took out on credit!

There is something greater going on here than just expanding the national deficit/debt (not sure which word is appropriate here). This is a subtle way for the government to make people totally reliable on it. THEY will unfreeze credit and encourage folks to spend more money (that they don’t have) then when it comes time to pay the bill, THEY will be there with another stimulus plan to help pay the bill. It is a vicious cycle to make the public dependent on big government. Ideals like self-control and delayed gratification are no more. Let Uncle Sam get you that loan for whatever you want and when it’s time to pay up, let Uncle Sam do that for you too. Meanwhile all the taxpayers in American are paying for the government to fund your irresponsibility.

Rachels last blog post..Breaking Hiatus Again… This Time For Fun

The problem is much what Ling said earlier, if the government is going to continue to inflate money and bail you out when you make mistakes, why should you save, why should you not get into as much debt as possible? It’s like doing whatever kind of dangerous thing imaginable because there’ll always be a safety net. You’d be foolish not to, wouldn’t you?

To me, somewhere along the line it becomes a moral issue rather than just a numbers issue. Once you get there, you start to ask the interesting questions.